Paying your Old Navy credit card bill quickly and easily is important to avoid late fees and keep your credit score in good standing. With Old Navy cards issued by Barclays Bank, you have several convenient options to pay your bill online, by phone, or by mail. This comprehensive guide will walk you through all the steps and information you need to pay your Old Navy credit card bill.

Overview of Old Navy Credit Cards

Old Navy offers two different credit cards – the Navyist Rewards Credit Card and the Navyist Rewards Mastercard Both cards offer generous rewards and perks like

- Earn 5 points per $1 spent at Gap, Banana Republic, Athleta, Old Navy and other affiliated stores

- Earn 1 point per $1 spent elsewhere

- Points can be redeemed for rewards to use like cash on future purchases

- No annual fee

The Navyist Rewards Mastercard can be used anywhere Mastercard is accepted, while the Navyist Rewards Credit Card can only be used at Gap family stores However, both offer the same rewards program and benefits

Having one of these cards allows you to easily earn rewards on your Old Navy purchases. But to enjoy the benefits, you have to pay your bill on time each month.

When is Your Payment Due?

On your printed statement or online account you will see a payment due date. Payments are due on the same date each month.

For example, if your due date is the 15th of the month, your payment for the previous month’s charges needs to be made by the 15th to avoid a late fee.

Payments are considered on time if they are made by 11:59 pm Eastern Time on the due date when paying online or by phone. Mailed payments need to be received by 5 pm local time at the payment address to avoid late fees.

How Much Should You Pay?

You need to pay at least the minimum payment amount by the due date to keep your account in good standing. This amount will be printed on your statement. It is typically around 2% of your statement balance.

To avoid interest charges, you’ll want to pay your statement balance in full each month if possible. Any remaining balance will start accruing interest around 26% APR.

Online Payment Options

Paying your Old Navy credit card bill online is the fastest and most convenient option. Here are the easy steps to pay online:

-

Go to oldnavy.barclaysus.com and click “Log In”

-

Enter your username and password and click Log In

-

Follow the prompts to “Make a Payment”

-

Enter your payment amount and submit

-

The payment will be processed immediately

The online payment system is available 24/7 so you can pay your bill anytime. You’ll need to have your account number, payment amount, and banking information ready.

When logging in the first time, use the last 4 digits of your SSN and account number to register your account online.

Pay By Phone

Calling in your payment is another quick option. Have these items ready:

- Your account number

- The payment amount

- Your banking information

Then call 866-621-0532. Follow the prompts to make a payment. Phone payments are processed immediately.

This automated phone payment system is available 24 hours a day, 7 days a week.

Paying by Mail

If you prefer to mail in a check or money order, here are the steps:

-

Write your account number on your check or money order

-

Make it payable to Barclays Bank

-

Write the payment address found on your statement on the envelope

There are two different addresses that can be used:

-

Card Services, P.O. Box 60517, City of Industry, CA 91716-0517

-

Card Services, P.O. Box 13337, Philadelphia, PA 19101-3337

- Mail it at least 5 business days before your due date to ensure it arrives on time

Pay at Store Locations?

While Old Navy has over 1,200 store locations, you cannot make credit card payments in person at any Old Navy stores. All payments must be made online, by phone, or mailed to one of the addresses above.

The stores do not have envelopes, terminals, or any way to accept credit card payments.

Late Payments

If you miss the payment due date, you will be charged a late fee up to $41. To avoid late fees, make sure your online or phone payments are made by 11:59 pm ET on the due date, or mailed payments are received by 5 pm local time at the payment address.

You can use any of the payment options above to make a late payment and get your account back in good standing. But late fees will still apply based on how many days past the due date the payment is made.

Set Up Automatic Payments

One of the easiest ways to avoid forgotten or late payments is to set up automatic recurring payments through your online account. You can select auto-pay for the minimum payment or full statement balance each month.

Just log into your account, go to the Auto Pay section, and enter your preferred payment amount and checking account information. This will withdraw the funds automatically each month by the due date.

You can cancel or adjust the auto-pay amount at any time if needed. Enable notifications so you still remain aware of your payment dates and amount.

Payment History

Your account online will show your recent payment history and all payment details. You can check here to ensure payments went through as expected and your current account balance.

Print or download statements for your records as needed. Log in anytime to check your up-to-date rewards balance and redeem points.

Get Account Alerts

Make sure you enable account notifications and alerts through your online account or mobile app. You can receive alerts for:

- Payment reminders

- Statement ready alerts

- Suspicious activity alerts

- Rewards notifications

- and more!

Having your payment due date and other account alerts sent right to your phone helps ensure you never miss a payment.

Avoid Interest Charges

These Old Navy credit cards have relatively high interest rates around 26% APR. Any unpaid balances will start accumulating interest charges after the due date.

To avoid costly interest fees, always pay your full statement balance by the due date. Carrying a balance month-to-month is not recommended with these retail cards. If needed, make payments multiple times per month.

Redeeming Rewards

One of the best perks of the Navyist Rewards Credit Card and Navyist Rewards Mastercard is the rewards program. You earn 5x points per $1 spent at Gap Inc. stores and 1 point per $1 elsewhere.

Points can be redeemed as rewards dollars to deduct from a future Old Navy purchase. For example, $10 in rewards can be used like $10 in cash towards your next Old Navy shopping trip.

Check your rewards balance and redeem your earned rewards often to maximize the benefits of the card. Rewards don’t expire as long as your account remains open.

Get the Old Navy App

Managing your Old Navy credit card is easier than ever with the Old Navy app. You can view your account, make payments, see your rewards balance, and get notifications. Paying your bill on the go is simple with the app.

Download the app for free from the App Store or Google Play Store. Log in using your same online account details to access your card account.

Avoid Account Closure

Like any credit card, avoiding late payments is crucial. If your account becomes significantly delinquent, Barclays may close the account completely meaning you would lose any accumulated rewards.

To keep your account open and active, be sure to pay at least the minimum payment amount before the due date every month. Keep your account balance low and credit usage under 30% to avoid risking account closure.

Get a Credit Limit Increase

As you responsibly use your Old Navy card and maintain your account in good standing, you may qualify for a higher credit limit. Having a higher limit means you can make larger purchases and earn rewards faster.

Requesting a credit limit increase is easy to do online or over the phone. Generally, you’ll need to wait at least 6 months before requesting an increase. Approval is based on your income, credit history, and other factors.

Change Your Payment Due Date

If needed, you can request to change your monthly payment due date. Simply log into your account online and use the “Change Due Date” feature.

Pick any due date between the 1st and 28th of the month. The change will take effect with your next billing cycle. Adjusting your due date can help align all your bill payments for convenience.

Get a Replacement Card

Lost or stolen cards can be quickly replaced. You can request a new card online or by calling customer service. New cards are sent within 7-10 business days.

You can also enable temporary digital cards instantly through your online account or Old Navy app until the physical

k

Make an Old Navy Credit Card Payment Online

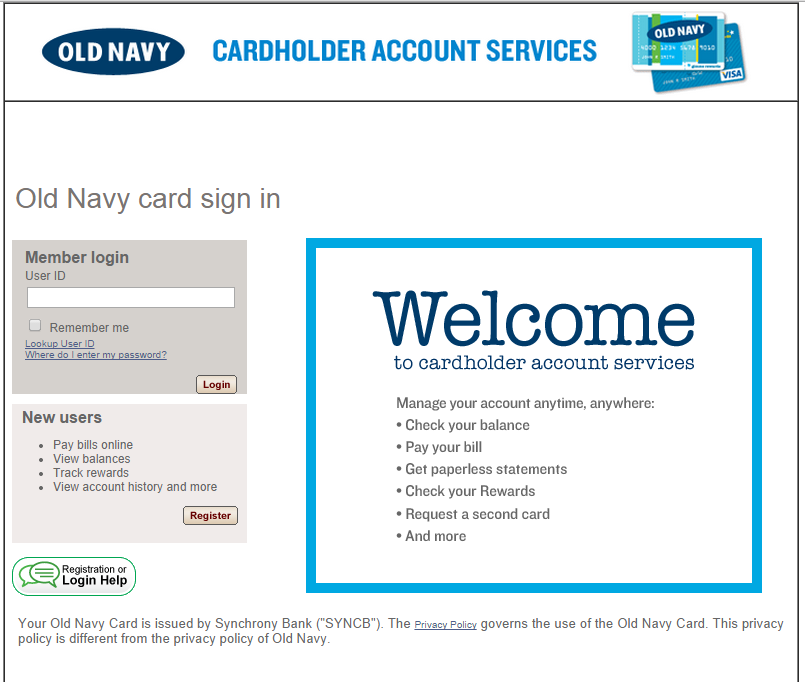

You’ll need to register for online access to your Navyist Rewards credit card or Mastercard account before you can make a payment. You can do that through the card login page by clicking “Set up online account” and entering the last four digits of your Social Security number, your account number and your occupation.

After you’ve registered your card, follow these steps to make a payment:

- Enter your username and password on the login page and click “Log in.”

- Follow the prompts to make a payment.

You can select “Remember username” before you log in to make the process a little easier next time, if you choose.

What To Do If Your Old Navy Credit Card Payment Is Late

You can use any of the Old Navy bill pay options to make a late payment. To avoid paying a late payment fee on a Navyist Rewards credit card or Mastercard, the minimum payment is due by 11:59 p.m. ET on the due date included on your statement if you make your payment online or by phone. If you make your payment by mail, it must be received by 5 p.m. local time at the payment address in order to be credited the same day.

For Barclays Old Navy cards, the late fee can be up to $41, or up to $15 for Iowa residents.

Information is accurate as of April 4, 2023.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

This article has been updated with additional reporting since its original publication.

Share This Article:

HOW TO PAY OLD NAVY CREDIT CARD ONLINE 2024! (FULL GUIDE)

FAQ

Can I use my Old Navy Credit Card at Walmart?

Can I Make an Old Navy payment over the phone?

How do I make an Old Navy credit card payment?

You can call 866-621-0532 to make your payment for your Navyist Rewards credit card or Navyist Rewards Mastercard. Make sure you have your card account number and payment information on hand. Can You Make an Old Navy Credit Card Payment in the Store? No, you cannot make in-store Old Navy credit card payments.

How do I make a late payment on my Old Navy Bill?

You can use any of the Old Navy bill pay options to make a late payment. To avoid paying a late payment fee on a Navyist Rewards credit card or Mastercard, the minimum payment is due by 11:59 p.m. ET on the due date included on your statement if you make your payment online or by phone.

How does the navyist rewards card work?

The Navyist Rewards Mastercard works anywhere that accepts Mastercard. Cardholders of either card earn points for purchases and can redeem those points for rewards that work like cash on future purchases. The cards have no annual fee and give cardholders early access to sales and exclusive offers.